ARB Hearings Boost Informal Savings to New Heights in Webb County

O'Connor discusses how ARB hearings boosted informal savings to new heights in Webb County.

LAREDO, TX, UNITED STATES, October 23, 2025 /EINPresswire.com/ --Webb County is centered on Laredo, but the border with Mexico is the true star of the county. This has made the county a hub for immigration, international trade, and general commerce. As one of the most populus counties in Texas, Webb continues to grow thanks to its key location and thriving economy. Like fellow border counties Hidalgo and El Paso, Webb has been seeing a solid increase in both residential and business property values in the past decade, with the total market value for all property doubling.

Thanks to the working-class nature of Webb County, every increase to a home or business can be devastating. In 2025, home values rose by 6%, while commercial property jumped a staggering 28%. While exemptions are the first step, the best weapon to correct these errors is property tax appeals. While Webb County, much like Hidalgo and El Paso, has not fully embraced them, there is still a record number of them being filed. While informal appeals did not accomplish much, formal appeals to the appraisal review board (ARB) did bring in a small bounty. In this article, we will examine how these combined property protest types were able to find purchase and how they shaped the overall tax base of the county.

ARB Hearings Achieve Solid Residential Reductions

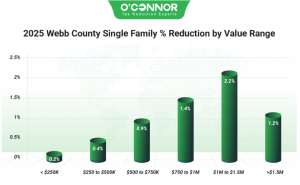

The Webb County Appraisal District (WCAD) assessed home values as having increased 6% in 2025, with it estimated that 27% of homes were overvalued. This resulted in a total of $14.26 billion. Informal appeals were not even able to move the total a single percentage point, but ARB hearings found much more success. When combined with informal appeals, protests managed to save 0.4%, reducing the total to $14.21 billion. Homes under $250,000 were the highest source of value, contributing $6.50 billion after a reduction of 0.2%. Those between $250,000 and $500,000 were reduced by 0.4%, achieving a total of $5.83 billion. Homeowners that used O’Connor for their protest saw an overall reduction of 2.7%, including a cut of 2.7% for homes worth under $250,000.

Webb County is built around modest homes, with $8.14 billion in value coming from homes under 2,000 square feet, following a reduction of 0.2%. $5.19 billion came from homes between 2,000 and 3,999 square feet, which was achieved thanks to a decrease of 0.5%. As homes got larger, so did their reductions, with those measured at 6,000 to 7,000 square feet saving 2.2% and those over 8,000 square feet saving 2.9%. This resulted in values of $139.48 million and $82.89 million respectively.

The largest source of housing value in Texas is usually built from 2001 to 2020, and Webb County is no exception. 45.5% of all value came from this timeframe, which translated into a final tally of $6.46 billion after a reduction of 4%. 29% or $4.12 billion came from homes built from 1981 to 2000, while 11.9% came from those constructed from 1961 to 1980. These both experienced reductions of 0.4%. New construction had added 23.6% to its value in 2025, but this was countered by a reduction of 0.3%, which meant a final figure of $32.02 billion.

Combined Appeals Help Shield Business Owners from Huge 28% Gain

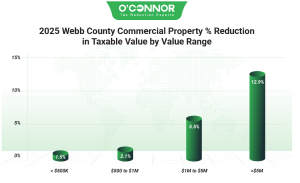

While the increases for homes and their appellant decreases were important, they were dwarfed by what occurred in the world of commercial property. To start off 2025, WCAD handed out an enormous 28% increase to business real estate, resulting in a final total of $12.01 billion. While informal appeals were only able to secure a reduction of 0.3%, when combined with ARB hearings, protests managed to achieve a cut of 8.1%. This dropped the total to $11.03 billion. The largest value category was businesses worth over $5 million, which saw a reduction of 12.9%, leading to a tally of $4.75 billion. Businesses worth between $1 million and $5 million were reduced by 5.5%, reaching $3.94 billion. O’Connor was able to land clients with an overall reduction of 16.3%, including a whopping 19.6% for commercial properties over $5 million.

Due to its nature as a major nexus of trade, the largest commercial property type was warehouses, which originally saw a total of $4.52 million before being reduced 7% to $42.00 billion. Raw land was next, dropping 1.2% to $3.45 billion. Apartments, typically the No. 1 property in Texas, got a solid reduction of 13.9%, which took their total to $1.31 billion. Offices dropped 11.4% to $937.66 million, while retail scored an impressive 21.8* cut to reach $920.85 million. While no property type was able to use appeals to reduce their gains entirely, they were able to significantly mitigate them.

Business properties are not quite as reliant on the boom period of 2001 to 2020 to create value, but these pieces of real estate still contributed 29.2% of all value, roughly $3.22 billion after a solid reduction of 12.9%. These had previously spiked 24.5%. Businesses built between 1981 and 2000 were in second place with $2.22 billion, which was achieved after a cut of 9.9%. New construction was the big story, as it stormed into 2025 with a rise of 96.8%. This was slowed by a decrease of 7.6% but still managed to reach a final tally of $1.44 billion. The “other” category refers to raw land.

Offices Land Some of the Best Reductions in Webb County

Out of all major commercial property categories, offices received a cut closest to their original rise. Offices had initially risen 19.3% to $1.06 billion, before being reduced by 11.4% to $937.65 million. 49% of all office value was built between 2001 and 2020, a total of $459.21 million after a sizeable reduction of 13.9%. Those from 1981 to 2000 fell 9.2% to $307.69. New construction was in a distant third place with $86.99, following a decrease of 7.7%. New offices had previously jumped 44.9%. Owners of new offices saved 21.7% with O’Connor, while the total value for all offices was reduced by 19.2%.

WCAD broke down offices into just two categories. Low-rise office buildings experienced a reduction of 11.6%, giving them a new total of $937.66 million. Medical offices dropped 10.2% to $180.30 million. These had previously increased 20.6% and 13.2% respectively.

Appeals Save Warehouse Owners $361 Million in Taxable Value

Warehouses were the No. 1 business property in Webb County, beating all others by a wide margin. These initially totaled $4.16 billion with an increase of 35.2%. This was eventually knocked down a bit to $4.20 billion, thanks to a savings of 7%. As usual, the first-place category was warehouses constructed between 2001 and 2020, which reached $1.49 billion after a reduction of 6.7%. Following a cut of 8%, those built from 1981 to 2000 had a final sum of $1.32 billion. These had increased 20.6% and 21.2% respectively. The main reason for the titanic overall increase was new construction, which added an astounding $107.2% in value in 2025. This was reduced by 7.1%, for a final total of $1.18 billion. We at O’Connor were able to save warehouse owners 14.3% in total, with a savings of 20% for new construction.

WCAD used three subtypes for warehouses. Generic warehouses dropped in value by 7% thanks to appeals, totaling $3.07 billion. Mega warehouses scored a mega savings of 6.9%, falling to $1.04 billion. With a cut of 9.3%, mini warehouses were fittingly the smallest in value, with a final tally of $88.95 million.

About O'Connor:

O’Connor is one of the largest property tax consulting firms, representing 185,000 clients in 49 states and Canada, handling about 295,000 protests in 2024, with residential property tax reduction services in Texas, Illinois, Georgia, and New York. O’Connor’s possesses the resources and market expertise in the areas of property tax, cost segregation, commercial and residential real estate appraisals. The firm was founded in 1974 and employs a team of 1,000 worldwide. O’Connor’s core focus is enriching the lives of property owners through cost effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program ™. There is no upfront fee, or any fee unless we reduce your property taxes, and easy online enrollment only takes 2 to 3 minutes.

Patrick O'Connor, President

O'Connor

+ + +1 713-375-4128

email us here

Visit us on social media:

LinkedIn

Facebook

YouTube

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.